Update, Nov. 16: At their Wednesday meeting, the county commissioners unanimously approved the Active Volunteer Real Estate Tax Credit program.

Previously reported:

Lancaster County is poised to enact an ordinance Wednesday that would provide a $150 tax credit to eligible volunteer fire and emergency medical personnel.

Local volunteer fire departments and ambulance services are struggling to attract and retain personnel. The tax credit would provide a modest incentive to those who serve, helping with what the three county commissioners agree is an acute staffing challenge countywide, and indeed nationwide.

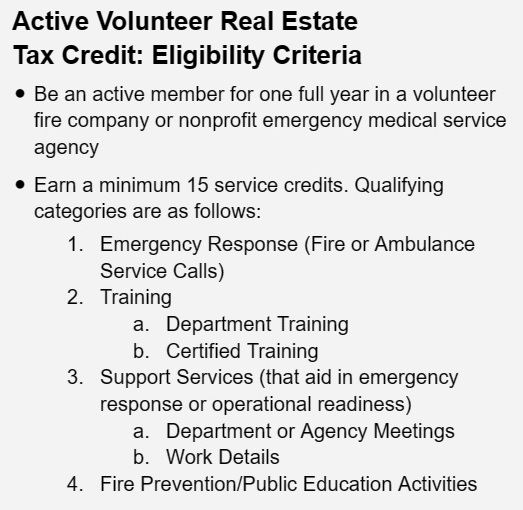

To be eligible for the tax credit, individuals must have served with a fire or EMS department for one full year and have earned at least 15 service credits. Individuals can earn a credit for each fire or EMS dispatch call and each hour of training or eligible work.

The county intends to implement the credit beginning next year, allowing emergency responders to earn it for their service in 2023. The county estimates that 1,300 to 1,500 individuals will be eligible to apply, and accordingly is allocating $250,000 in the 2024 budget, Commissioner Ray D’Agostino said.

The county worked with the Lancaster County Fire Chiefs Association to develop the program. The association is in full support, as it is of anything that helps agencies recruit and retain staff, Manheim Township Fire Chief Scott Little, the association’s president, said during a brief formal hearing Tuesday morning.

The hearing was a procedural requirement for enacting the ordinance. Apart from Little’s comment and a question from One United Lancaster, there was no public comment.

Counties are allowed to enact the tax credit under a state law that allows municipalities to do the same, giving volunteer emergency personnel a break on local property and earned income taxes. The commissioners said they hope the county’s tax credit inspires localities to enact their own.

“Hopefully, it’s a first step,” D’Agostino said.