Gov. Tom Wolf on Wednesday unveiled a proposed 2021-22 budget for Pennsylvania that would dramatically reshape the state's tax structure and its shift its spending priorities, redirecting millions of dollars to school districts that advocates say are being shortchanged under the current system.

Related: Gov. Wolf outlines goals for 2021

Related: Here's how Gov. Wolf's budget would change Lancaster County school funding

Rebutting any notion that the coronavirus pandemic — and the hole its economic impact has blown in the state's revenues — necessitates fiscal retrenchment, Wolf said it would be wrong to postpone "lifting the barriers" that stand between struggling young families and the lives they hope to provide for themselves and their children.

"Indeed," the governor said, "I think it’s more important than ever that we act boldly and courageously to remove those barriers once and for all."

The governor proposed increasing basic education funding by $1.35 billion, about 20%. Money would be allocated to school districts using the state's Fair Funding Formula, which takes ongoing enrollment changes and demographic shifts into account. An adjustment would ensure that no district's funding is cut.

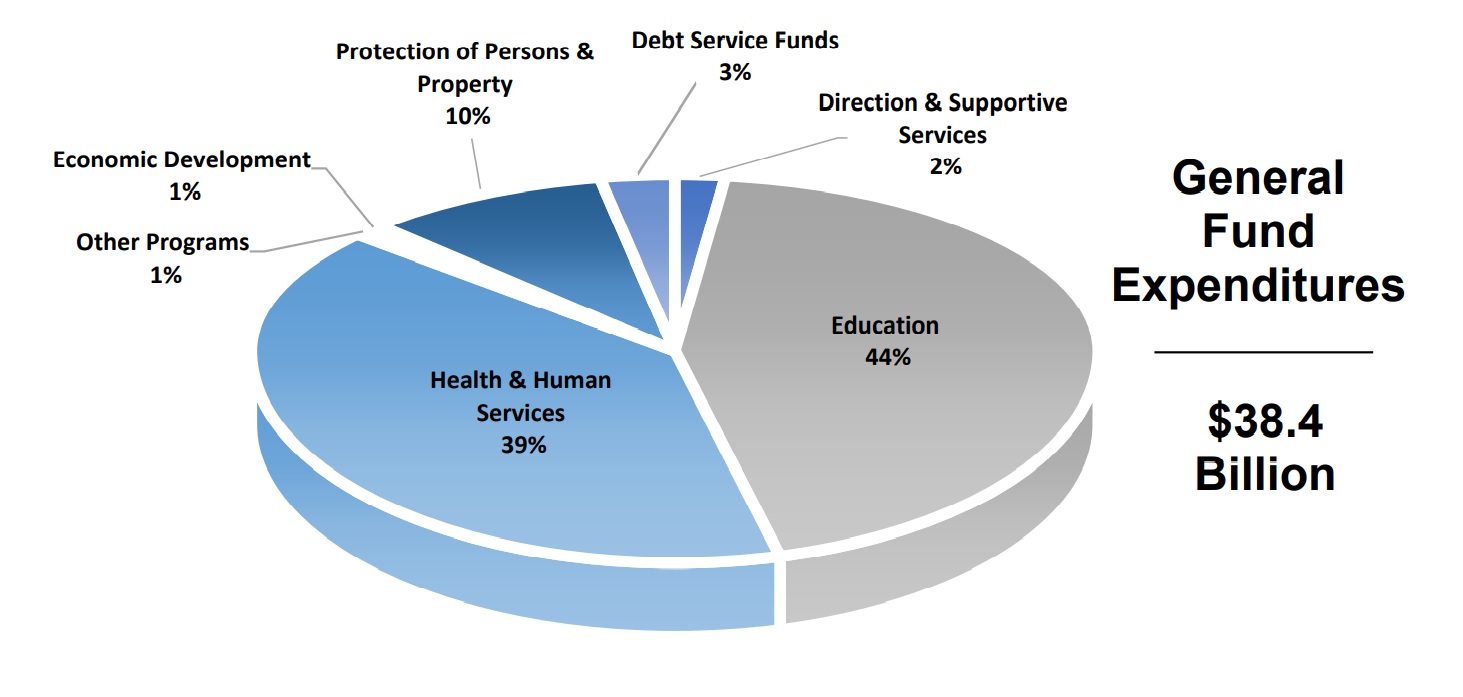

His total proposed general fund spending is $38.4 billion. That's 4.9% more than current fiscal year spending for 2020-21 of $36.6 billion — $33.1 billion augmented by $3.5 billion in federal aid.

As is typical for state budgets, more than $4 out of every $5 would go to education, health and social services.

To accomplish his goals, "Wolf will likely need to scrounge more than $8 billion," reports the Associated Press.

A tax hike + tax forgiveness

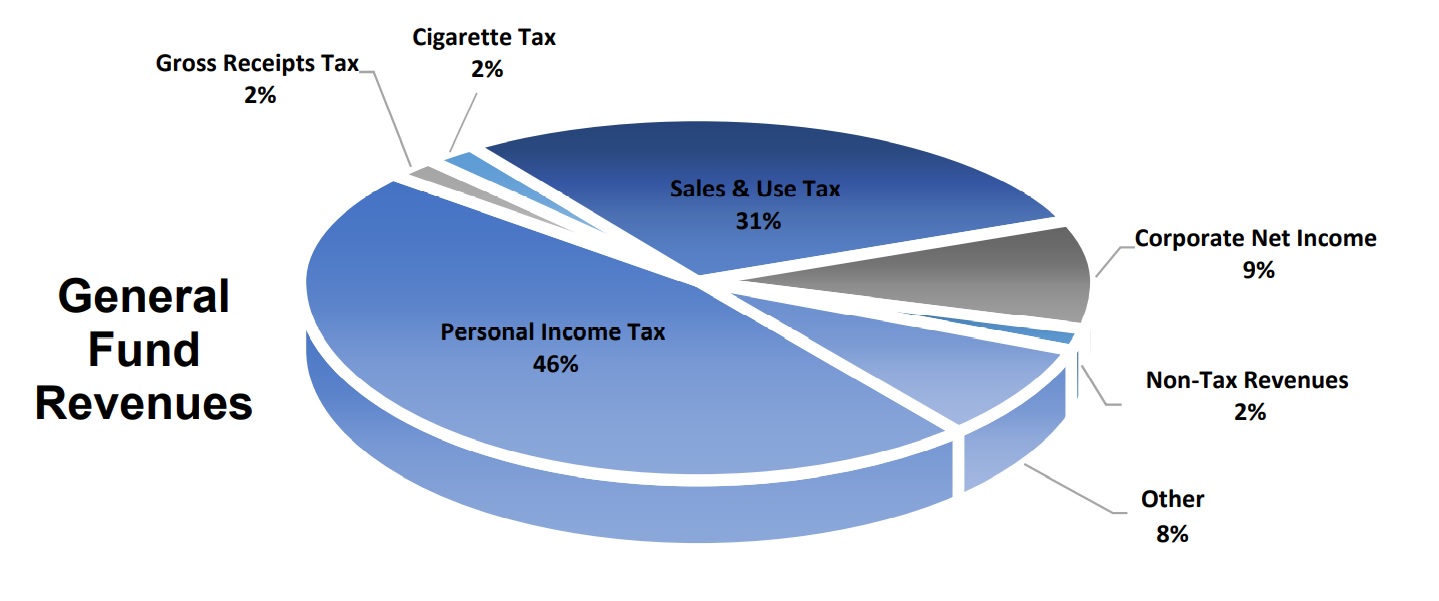

To raise revenue, Wolf proposes increasing the personal income tax rate from 3.07% to 4.49%. A tax forgiveness credit would offset the change for low- and middle-income families. For example, married couples that earn less than $84,000 would see a net tax cut, Wolf said.

The changes would result in about $4 billion in additional revenue, a roughly 25% increase, according to administration officials.

The governor also called for enacting a severance tax on natural gas and legalizing marijuana, sales of which would also be taxed.

He reiterated Democrats' longstanding proposal to close the Delaware loophole, which allows companies to avoid paying Pennsylvania's corporate income tax, in exchange for reducing the rate.

Among other components of Wolf's proposal:

- Increase the minimum wage to $12/hour, and eventually to $15/hour;

- Provide $3 billion to help Pennsylvania's economy recover from the pandemic;

- Increase funding for Pre-K Counts, Head Start and special education;

- Assess a state police service fee on municipalities.

Welcomed on the left, blasted on the right

Wolf's budget has little to no chance of becoming law. It faces both a forbidding fiscal climate and tooth-and-nail opposition from the Republican-majority General Assembly.

"The budget he is presenting is completely unsustainable, totally irresponsible and absolutely crippling to the state's economy," Senate Majority Leader Jake Corman said in a statement.

The conservative Commonwealth Foundation said Wolf's tax hike would be the largest in state history, and would punish small business owners, since many set up their businesses as "pass-through" entities.

It accuses him of increasing spending and piling up debt without improving Pennsylvanians' standard of living.

The left-leaning Pennsylvania Budget & Policy Center praised the budget, endorsing Wolf's contention that it would reduce existing inequities in education funding and tax incidence.

Under Wolf's plan, "more than 40% of Pennsylvania families will see their taxes go down and the taxes for another 27% will stay the same," the PBPC said. "Only the most well-off third of Pennsylvanians would pay more. After decades of increasing inequality, that has been exacerbated by the pandemic, a tax proposal along these lines is overdue and should be welcomed by all of us."

Full information on the spending plan is available here.