Thanks to American Rescue Plan Act funds, Lancaster city government does not need to raise property taxes for 2024, Mayor Danene Sorace said.

After that, however, with ARPA no longer available, “we have our work cut out for us,” the mayor said.

Sorace made her comments in the course of delivering her 2024 budget address to City Council Tuesday evening. Council members received the 245-page draft budget as well; it was posted on the city website Wednesday.

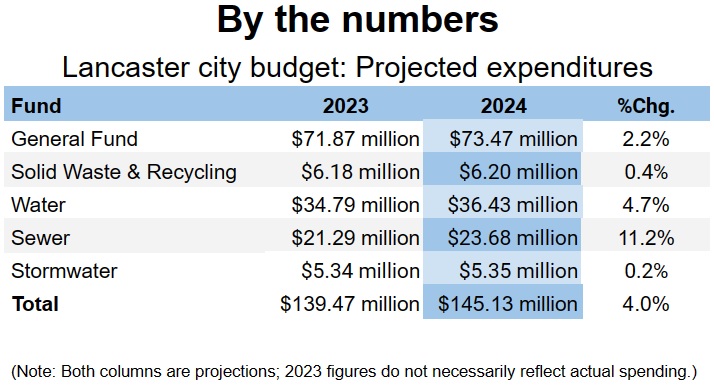

The budget calls for general fund spending of $73.5 million, up 2.2% from 2023. The city is able to cover that increase with $6 million of ARPA “revenue replacement” funds and $2.2 million in reserves.

Without ARPA and reserves, revenue would be barely up at all, less than 1%, Sorace said.

The $2.2 million in reserves is available thanks to an austerity initiative this year. It achieved about $2 million in savings through unfilled and eliminated positions and other targeted cuts. The city will be able to “roll over” those savings into 2023 without further tapping its reserves, Sorace said.

The increased spending stems from salary increases, averaging 3% across union and non-union staff, plus about $1.5 million in increased debt service and retiree benefits.

At 2.2%, the budget increase is below the annual inflation rate, which was 3.2% as of October.

As is usual, general fund expenses are dominated by public safety. The Bureau of Police is budgeted at $29.24 million and the Bureau of Fire at $13.23 million, for a total of $42.47 million, or about 58% of all general fund outlays.

The budget allocates $900,000 for police overtime. That’s based on how expenses have been running this year, Sorace said. The disbandment of the department’s mounted unit will give more flexibility and make those officers more available to respond to calls, but to make a dent in overtime, the department needs fewer unfilled positions, she said.

Enterprise funds

The city has four other budgets, termed “enterprise funds,” besides the general fund: Water, sewer, solid waste & recycling, and stormwater. They are funded by fees.

The budget proposes keeping stormwater and trash fees unchanged, Sorace said. It proposes a 10% increase in sewer rates, or $4.50 per month for the average residential customer. As for water rates, they would remain unchanged, but the city plans to add an additional charge known as a “Distribution System Improvement Charge.”

The charge will apply to all water customers, both inside and outside the city. The rate will be set by the Public Utility Commission and will probably take effect in February. It will be no more than 5% of customers’ usage charges, Sorace said.

“In sum, Council will be asked to consider one rate increase as part of this year’s budget, while also recognizing that water customers will see a modest increase,” Sorace said.

2024 vs 2023

Last year, after four years without a property tax increase, City Council approved a 2023 budget with an 8% property tax hike, raising the rate to 12.64 mills, and increases in all four fees. In all, the budget raised costs for the typical homeowner by nearly $300 a year.

One mill is equal to $1 per $1,000 of property value.

The mayor’s budget address normally comes during City Council’s second November meeting. Sorace said she wanted council to have the budget earlier this year because that second meeting comes so late in the month: Nov. 28, after Thanksgiving.

The plan had been to introduce the city’s budget ordinance and property tax ordinance on Tuesday. However, the state’s Third Class City Code bars that from happening until the last November meeting. Accordingly, City Council voted to remove the ordinances from the evening’s agenda.

Sorace said she will advise the Home Rule Study Commission, if it ends up drafting a charter, to provide a more flexible timeline for budget review and adoption.

The commission is to decide on whether to draft a charter early next year. If it moves forward, a charter could be presented to voters for ratification that November, potentially giving the city flexibility in setting earned income tax rates for the following year, 2025. At present, under the Third Class City Code, Lancaster’s EIT is capped at 1.1%, with 0.5% going to the School District of Lancaster.

Given the uncertainty, and the short time frame between the November election and the city’s deadline for a budget, Sorace said her administration will be gaming out multiple budget scenarios: One for the status quo, with no changes in tax flexibility, the others reflecting possible options in the event a home rule charter is enacted.

All the scenarios would involve a combination of tax increases and spending cuts. The business-as-usual scenario, however, would likely include both a property tax increase and “significant” staff cuts, she said.

At this point, the city is trying to wring further savings out operations that have already been subject to cuts and efficiency efforts over many years. With every cycle, Sorace told One United Lancaster, there is “less give in the system,” less that can be done without adversely affecting core city services.

What’s next

As mentioned, City Council will introduce the 2024 budget ordinance and property tax ordinance at its next meeting.

In December, Director of Administrative Services Tina Campell will provide City Council a budget overview presentation at its committee meeting Dec. 4. That will be followed by budget hearings Dec. 9, at which City Council hears from department heads about their activities and budget requests. City Council’s vote to adopt the budget is scheduled for Dec. 19.