With a little over a month to go until the April 18 deadline for submitting tax returns, Pennsylvanians are being encouraged not to overlook their options for free filing and ways to reduce their tax liability.

Tax Forgiveness

Low-income households in Pennsylvania are eligible for the state's Tax Forgiveness program, but more than 118,000 eligible filers don't take advantage of it, the Department of Revenue.

That includes more than 4,200 taxpayers in Lancaster County, who in 2019 failed to claim refunds worth just over $1 million, according to the department's county-by-county estimates.

Frequently, all they need to do is file a state income tax return and include the PA-40 Schedule SP, the department said.

About 20% of Pennsylvania households qualify for Tax Forgiveness. In recent years, more than 1 million taxpayers have claimed more than $240 million in refunds through the program.

"We want the public to know that there are refunds waiting for thousands of Pennsylvanians, including many low-income families and retirees who could greatly benefit from this money," Revenue Secretary Dan Hassell said in a statement. "If you have a neighbor, friend or family member whom you think may be eligible, please encourage them to check their eligibility and file a tax return with our department."

For full information, including income eligibility limits and forms, click here.

Child Care Tax Credit

The American Rescue Plan Act, or ARPA, authorized a substantial federal tax credit for families who paid for childcare in 2021.

The Child & Dependent Care credit will reimburse up to 50% of eligible costs, to a maximum of $4,000 per child or $8,000 per household. That covers nearly 40% of the average annual cost of childcare, according to the office of Sen. Bob Casey, D-Pa.

Importantly, it's a tax credit, not a deduction, meaning it provides filers a dollar-for-dollar reduction of their tax liability.

To claim the credit, you must have a record of your childcare expenses and your provider's name, address and tax ID. With that information, you or your tax preparer can fill out IRS Form 2441.

Tax credits vs. tax deductions

Tax credits save you much more money than tax deductions of the same dollar amount. Here's why.

Suppose you owe 15% tax on taxable income of $50,000. Your tax is $7,500.

If you have a $5,000 deduction, that reduces your taxable income to $45,000. Your tax drops by $750 (15% of $5,000), to $6,750.

If you have a $5,000 tax credit, on the other hand, that applies directly to your bottom-line liability. You now owe ($7,500 - $5,000) or just $2,500, or one-third of your initial obligation.

Other tax credits

ARPA authorized additional tax credits for income earned in 2021:

• Expanded Child Tax Credit: Up to $3,000 per child and $3,600 for children under six. Taxpayers who received monthly payments in 2021 may still be eligible to claim up to 6 additional months of payments.

• Earned Income Tax Credit: Tripled for childless workers to $1,502; special exception added to allow homeless youth and former foster care youth to qualify at age 18 rather than 19.

• Recovery Rebate Credit: Can be claimed by taxpayers who didn't receive 2021's final $1,400 Economic Impact Payment.

Free tax filing options

Free tax filing options

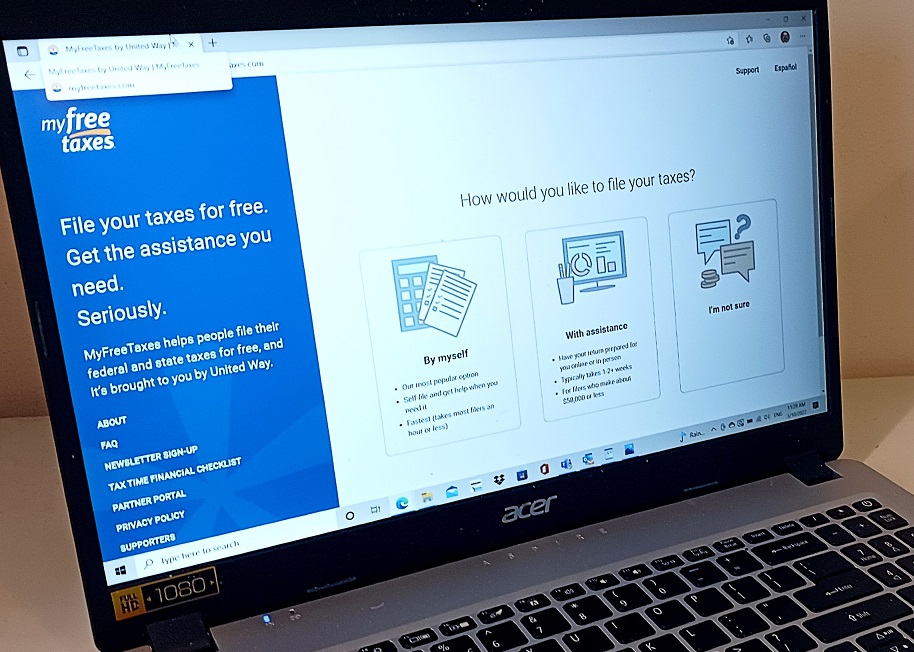

United Way of Lancaster County offers the free VITA tax preparation service to taxpayers making $62,000 a year or less. Eligible taxpayers can make an appointment online or access free online filing software through the Lancaster County VITA website.

The IRS offers additional options through its Free File program. Pennsylvanians can file their state taxes through the Department of Revenue's myPATH system.