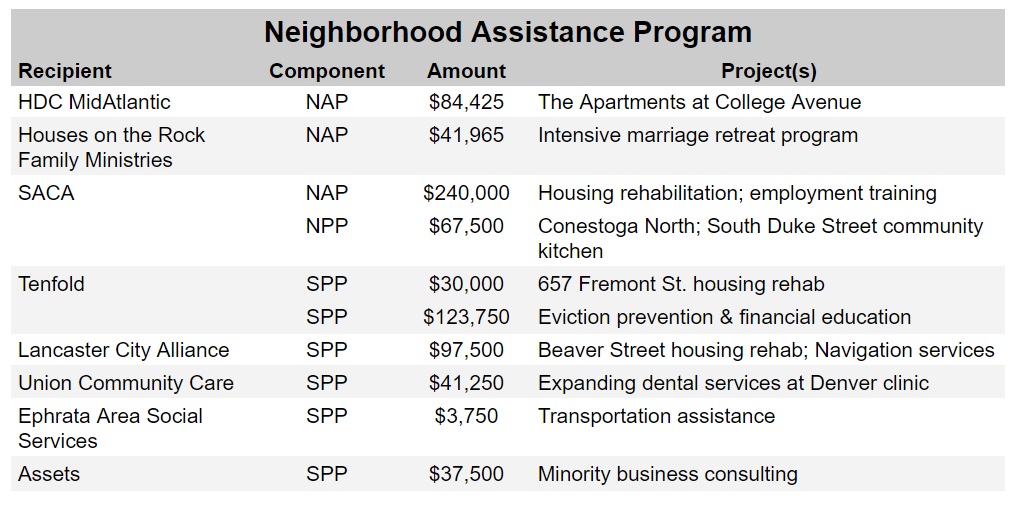

Eight Lancaster County nonprofit organizations have together received $767,640 through a state program that awards tax credits to businesses that contribute to projects in distressed or low-income areas.

The money was part of nearly $36 million distributed to 220 community revitalization projects through the state Department of Community & Economic Development's Neighborhood Assistance Program.

This year, priority was given to projects dealing with the Covid-19 pandemic, social justice, and "improving opportunities for marginalized populations," DCED said. The awards were announced this week.

The Neighborhood Assistance Program has five components:

- NAP: Neighborhood Assistance Program

- SPP: Special Program Priorities

- NPP: Neighborhood Partnership Program

- CFP: Charitable Food Program

- EZP: Enterprise Zone Program

"Communities from every corner of Pennsylvania will benefit from this funding – the result of public-private partnerships and cooperation," Gov. Tom Wolf said in a statement.

Tax credits lower businesses' tax liability. Credits awarded through the Neighborhood Assistance Program range from 25% to 80% of the eligible amount contributed, depending on the sub-program.